In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s a medical emergency, home repair, or funding a dream vacation, a personal loan can be a valuable resource. As technology continues to revolutionize the financial industry, online personal loans have emerged as a convenient and efficient way to access funds quickly. In this blog, we will delve into the power of online personal loans and how they offer borrowers the opportunity to secure the lowest interest rates, making them an attractive option for those in need of financial assistance.

The Convenience of Online Personal Loans

Traditional lending institutions have long been the go-to source for personal loans. However, the process of obtaining a loan from a bank or credit union can be time-consuming and laborious. In contrast, online personal loans have streamlined the entire borrowing experience. With just a few clicks, borrowers can apply for a loan from the comfort of their homes or on the go, using their computers or mobile devices. The digital application process is straightforward and generally requires minimal documentation, making it a hassle-free way to access funds in times of urgency.

Comparing Interest Rates Online

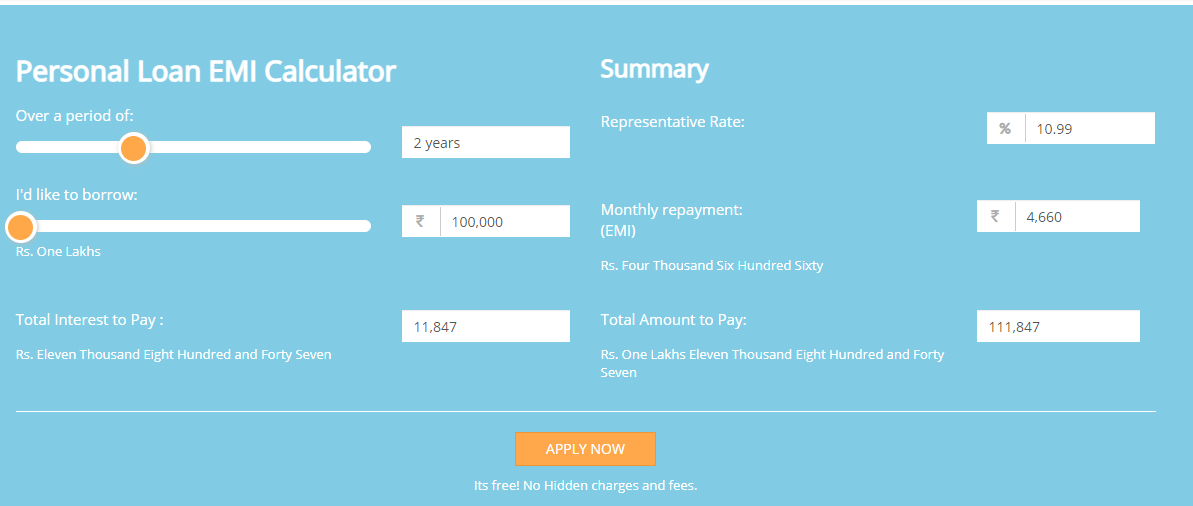

One of the most significant advantages of online personal loans is the ability to compare interest rates easily. With numerous online lenders vying for customers’ attention, borrowers can take advantage of this competition to secure the lowest interest rates available. Unlike traditional lenders, who might have limited loan options, online platforms offer a wide array of loan products, catering to various credit profiles and financial needs.

To find the best interest rates, borrowers can use online comparison tools and websites dedicated to personal loans. These tools allow users to input their loan requirements and credit scores, generating a list of lenders offering the most competitive interest rates. By comparing multiple offers, borrowers can make an informed decision and choose the loan that best fits their financial situation.

Factors Affecting Online Personal Loan Interest Rates

Several factors influence the interest rates offered by online lenders. Understanding these factors can help borrowers enhance their chances of securing lower rates. Some key elements include:

Credit Score: A strong credit score demonstrates a borrower’s creditworthiness and reduces the risk for lenders. Those with higher credit scores are more likely to qualify for lower interest rates.

Loan Amount and Term: The amount borrowed and the loan term can impact the interest rate. Larger loan amounts or longer terms may lead to slightly higher interest rates.

Income and Debt-to-Income Ratio: Lenders consider a borrower’s income and debt-to-income ratio to assess their ability to repay the loan. A stable income and lower debt-to-income ratio can positively influence interest rates.

Collateral: Some online lenders offer secured personal loans, which require collateral. Having collateral can result in lower interest rates since it provides additional security for the lender.

Tips for Securing the Lowest Interest Rates

To optimize the chances of obtaining the lowest interest rates on online personal loans, consider the following tips:

Improve Your Credit Score: Maintaining a healthy credit score by paying bills on time and reducing outstanding debts can significantly improve the interest rates offered.

Shop Around: Don’t settle for the first offer you receive. Shop around and compare rates from multiple online lenders to find the most favorable terms.

Choose the Right Loan Terms: Select a loan term that aligns with your financial capabilities. Shorter loan terms often come with lower interest rates, but ensure you can comfortably handle the monthly payments.

Consider Secured Loans: If possible, opt for a secured personal loan to leverage your assets and potentially secure a lower interest rate.

Conclusion

In conclusion, online personal loans, with the support of reputable platforms like IndiaLends, have revolutionized the way borrowers access funds. Embracing the convenience and efficiency of digital lending, individuals can now secure the lowest interest rates available. By taking advantage of IndiaLends user-friendly interface and comparing offers from multiple lenders, borrowers can make informed decisions to meet their financial needs. Remember to maintain a healthy credit score, select the right loan terms, and explore secured loan options to unlock the full potential of online personal loans with IndiaLends. So, why wait? Harness the power of IndiaLends and secure the lowest interest rates today!

Read more – HDFC Bank Personal loan – Enjoy lowest interest rates, easy EMIs & Flexible tenure

You must be logged in to post a comment.