Taking a Personal loan to meet the immediate financial requirement is the best decision if taken with proper financial planning. When you apply for a personal loan, various aspects require a lot of calculation and research. All that becomes easier by using a Personal loan EMI Calculator. Here is the step by step guide which helps you in understanding the importance of the Personal Loan EMI calculator:

Importance of EMI calculators

You can plan your EMIS well

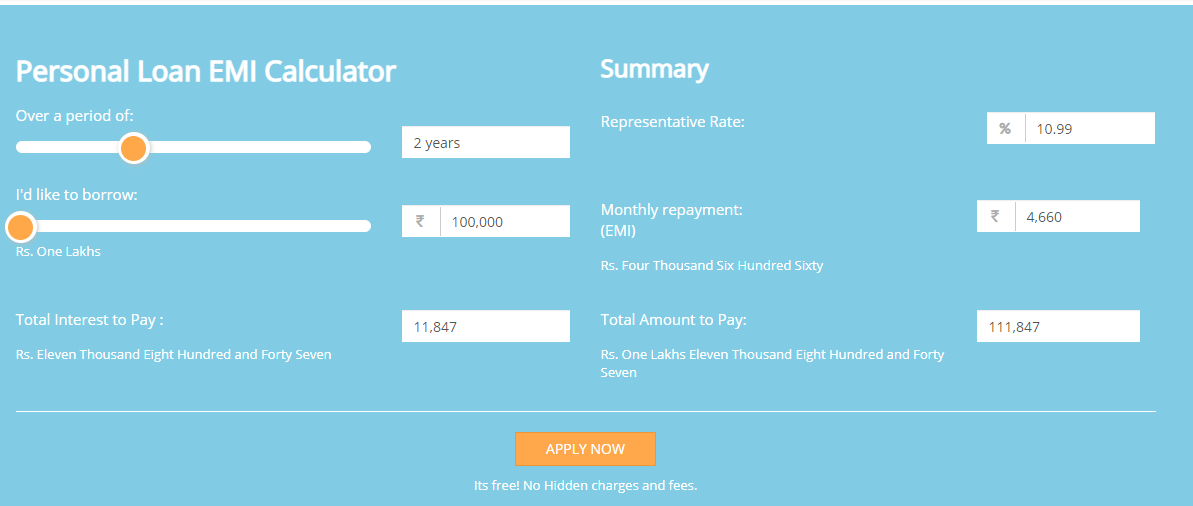

It is the first and most important aspect about EMIs. Using the calculator, you can easily calculate your EMIs that you are and can pay monthly. It will help you in understanding whether you can afford the loan or not. It would be a great help in getting insights on how to manage your expense during the loan tenure.

Know about the loan tenure:

You can find the best and perfect suitable loan tenure from the calculator. If you decide on paying a huge number of EMIs, you have to pay a less interest rate on the loan amount. To take the right decision on the loan tenure, the Personal loan EMI calculator allows you to alter the value and number of EMIS to understand and find out the best tenure of the loan.

Personal loan interest rate

The interest rate applies to Personal loan is one of the major aspects which require consideration. The interest offers by the lender based on various factors like loan tenure and EMIs. The personal loan EMI calculator proves to be the way of determining the best interest rate by altering the value till you are satisfied.

Loan eligibility

Using the EMI calculator, you can easily find out the loan eligibility before filing a loan application to avoid facing the drawbacks of loan rejection. When you put the loan amount on the calculator, it asks for the annual or monthly income, based on the calculator lets you know whether you have loan eligibility for the required amount or not.

Know your credit rating

When you are using the loan EMI calculator, you would have been given the option to enter your credit rating. In case, your credit rating is the bad and personal loan interest rate you have to pay is huge, you should not apply for a loan at that time and take some steps to build your credit rating.

Customizable:

Since the values of all aspects in the EMI calculator are customizable, you can alter the components of the EMI calculator till you are satisfied that you have gotten the best result. Therefore, it will help you in availing the perfect loan for you with the best possible values.

Conclusion

A Personal loan is the best solution to cover any necessary or urgent expenses that knock on your door unexpectedly. The best feature of these loans is that it offers freedom and flexibility to lead the lifestyle of your choice without affecting your other goal. Make the best use of these loans with a Personal loan EMI calculator and pre-determine your future EMIs.

Two most important form of Personal Loan Calculator is as follows:

Two most important form of Personal Loan Calculator is as follows:

You must be logged in to post a comment.